Sumitomo Mitsui Financial Group (SMFG) leads digitalization, implementing varied cutting edge technology into our products and services for enhancement of our customer experience, new business creation, and productivity improvement.

SMFG provides effective customer acquisition service with on-time / on-demand distribution of commercial promotion, using analysis of card holders’ profile and consumption history and locating customers with smartphones’ GPS function. Our newly launched biometrics authentication service is an example of our recent business creation, in which SMFG attempts to act as a platform leader. Application of AI at detecting credit card fraud, previously made by manual, enables SMFG to perform more efficient / accurate detection.

At this opportunity, SMFG presents our varied innovative projects, including, but not limited, API, and IoT products.

- All you need is you. - Biometric authentication platform

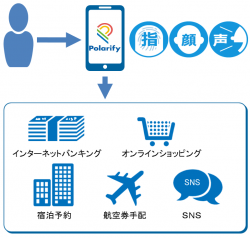

The Polarify app enables the users to log-in to varied services, via the common biometric authentication platform.

Biometric authentication platform "Polarify"

Polarify is a fintech company established in May 2017. It is the first fintech company approved by the Financial Services Agency of Japan after the amendments to the Banking act.

Currently, with the prevalence of On-line transactions, users have to manage multiple user IDs and complex passwords for different systems.

Next generation technologies such as Biometric authentication can verify user’s identity by means of human characteristics, instead of input in various user IDs and passwords to log in.

Polarify is a platform service that allows users to use their fingerprints, face or voice to access variety of business providers.

Furthermore, Polarify connects users and business providers through 1. Multiple, 2. Secured and 3. Advanced biometric authentication:

1. Multiple

Polarify provides users the choice of multiple authentication methods such as fingerprints, face and voice recognition for different purposes at different places and different times.

2. Secured

Polarify has adopted the FIDO authentication framework – UAF, that stores biometric data to the device and lowers the risk of leak to Internet.

3. Advanced

Polarify uses the most advanced Biometric authentication technology and continues to upgrade its verification engine.

Polarify aims to build a public authentication platform that various business providers can join.

There are three main merits when joining the platform:

1. Online channel activating

Through new service information and routine notification for inactive users, Polarify can promote the utilization of the on-line channel.

2. Information Sharing

In case of malicious utilization, Polarify will share the related information with all participants.

3. Cost Reduction

Polarify is more economical and can decrease the investment and expenses for additional authentication, compared to using separate biometric authentication platforms.

Polarify plans to 1. add new authentication method, 2. release app for web browser and tablet and 3. cooperate with credit card transaction and my-number card verification in the near future.

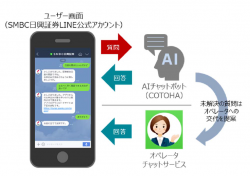

Use image. AI Chatobot is equipped with an escalation function that redirects customers to an operator for answers to questions that could not be resolved via AI Chatbot.

Use image of new functions. Once you tap My dashboad, you can use share price inquiries, fund eye, and market information menu.

SMBC Nikko Securities AI Chatbot

SMBC Nikko's AI Chatbot is capable of understanding customer input on LINE Talk to a high degree of precision and then automatically and rapidly providing the most appropriate response.

The I Chatbot now provides guidance on ways to open accounts as well as on initial public offerings (IPO), NISA, My Number, and Direct Course, and the scope of this service will be steadily expanded to include such things as share price or account balance inquiries, investment trust trading support tool "fund eye", and market information. We are also planning to extend the service time to night and holiday in near future.

This service utilizes an NTT Communication's AI engine (the communication Engine “COTOHA”; hereinafter, “COTOHA”) that can engage in “human-like dialogue”. COTOHA excels at understanding customer inquiries and providing natural responses by such means as automatically asking questions about missing information. COTOHA also studies the responses of operators in order to automatically upgrade its own response capabilities and comes equipped with an escalation function that redirects customers to an operator for answers to questions that could not be resolved via AI Chatbot.

SMBC Nikko Securities believes that utilizing AI for some of its operator operations at the Contact Center will cut down on overtime and otherwise reform work styles to help employees achieve a good work-life balance. Efforts will be made to further improve quality and enhance the operator training system so that customers can easily make inquiries at any time.

Sumitomo Mitsui Banking Corporation

http://www.smfl.co.jp/english/

Sumitomo Mitsui Finance and Leasing Company, Limited

http://www.smbcnikko.co.jp/en/index.html

SMBC Nikko Securities Inc.