About Futuresource Consulting

Futuresource Consulting, the specialist research and consulting company, is delighted to be the official knowledge partner for CEATEC. The company can trace its roots back to the 1980s and provides market insights into consumer electronics, digital

imaging, entertainment media, broadcast, optical manufacturing, storage media, professional IT and education technology.

With more than 70 full-time employees providing in-depth analysis and forecasts across consumer and professional

electronics categories, Futuresource is able to advise on market, competitive and technological developments, providing clients with access to the information that helps produce the best possible results.

2021/9/30

MicroLED is on track to displace LCD and OLED in consumer TV applications. That’s according to a new MicroLED report from Futuresource Consulting, which predicts global players will invest more than $10 billion into the technology over the next few years, creating a $50 billion + cumulative market opportunity over the next decade.

2021/9/30

Streaming music subscriptions have climbed sharply during lockdown according to a new Futuresource consumer survey, with 22% of respondents saying that they signed up to a new service. The Audio Tech Lifestyles research study, conducted across the USA, UK, Germany, Japan and China in June 2021, also uncovered a growing demand for high quality audio.

2021/8/31

August 26th 2021 - Cars are becoming smart and connected, opening up a wide range of new use cases and business models for the audio industry, as explored in a new report from Futuresource Consulting.

2021/8/31

August 11th 2021 - The global virtual assistant market posted another strong year in 2020, achieving 15% shipment growth. That’s despite the challenge of the COVID-19 pandemic, which applied the brakes to many industries and CE categories.

2021/7/31

Headphones stood out as the top tech product purchased during lockdown, with nearly a third of respondents indicating that they spent more than they usually would pre-pandemic.

2021/7/31

The world experienced an unprecedented shift towards video conferencing in 2020, accelerating conference camera shipments to an all-time high of 1.2 million units, according to a new report from Futuresource Consulting.

2021/6/30

The global wearables market continues to thrive, sidestepping any negative fallout generated by the COVID-19 pandemic, and achieving 35% volume growth in 2020. That’s according to a newly-released market report from Futuresource Consulting.

2021/6/30

As hybrid working becomes commonplace and companies seek video-ready meeting room solutions, the collaboration bars market is experiencing rapid expansion.

2021/3/30

March 10th, 2021, In 2020 the value of the Home Audio market was the highest it has ever been, rising 4% to $19.8 billion. This is partly driven by the pandemic, which in forcing people inside has supercharged interest in music and media consumption.

2021/3/30

March 1st, 2021-Futuresource’s Home Working survey asked 1,500 employees across America, France, Germany, and the UK about the impact COVID-19 has had on their working patterns, as well as the use of work technology in the home.

2021/2/28

January 20, 2021 - Over recent years, the audio market has witnessed a progressive shift to more premium products. Case in point with headphones and models such as the Apple AirPods Pro, along with the Sony WH-1000XM series, which have helped democratising higher audio quality to the mass-market.

2021/2/28

January 18, 2021-According to Futuresource Consulting, the hearables market has continued to demonstrate rapid growth, 60% year-on-year, from 2019 through to 2020, with COVID-19 inspired use-cases expected to propel it even further, to reach a forecasted $71 billion in 2024.

2021/1/19

January 14, 2021-The headphones category has experienced phenomenal development over the last decade.

2021/1/19

The global market for virtual assistants (VAs) continues to exhibit robust performance, propelled by enhancements in the underlying technologies along with increasing penetration across Consumer Electronics.

2020/12/23

The global economy has been decimated by COVID-19. While governments continue to try and contain the pandemic, industries and societies have had to adapt.

2020/12/23

2020 has turned the global TV market on its head. Earlier this month, Futuresource Consulting’s Tristan Veale presented to the SMPTE on this changing TV and media landscape.

2020/11/30

The gaming accessories market continues to climb, on track to achieve 21% volume growth in 2020, according to a new report from Futuresource Consulting.

2020/11/30

Amongst the dreadful impact that COVID-19 has had on both families and businesses around the world, one positive to focus on is the opening that the pandemic has provided for consumers to express their creativity.

2020/10/31

20 Oct 2020 - Active noise cancelling (ANC) headphones has been moving into the foreground over the last few years, advancing from 7% of volumes in 2018 to 9% last year. It is expected to capture as much as 20% of the market in 2020. Luke Pearce, Headphones Analyst at Futuresource Consulting, explores the rise of ANC and what it means for the future of the headphones industry.

2020/10/31

20 Oct 2020 - Smart security, monitoring and lighting devices for the home have witnessed an overall upsurge in growth this year, on track to achieve 120 million shipments worldwide. That is according to Futuresource Consulting’s newly-released report on the segment, which shines a light on the shifting consumer landscape.

2020/9/30

20 Oct 2020 - Active noise cancelling (ANC) headphones has been moving into the foreground over the last few years, advancing from 7% of volumes in 2018 to 9% last year. It is expected to capture as much as 20% of the market in 2020. Luke Pearce, Headphones Analyst at Futuresource Consulting, explores the rise of ANC and what it means for the future of the headphones industry.

2020/9/30

20 Oct 2020 - Smart security, monitoring and lighting devices for the home have witnessed an overall upsurge in growth this year, on track to achieve 120 million shipments worldwide. That is according to Futuresource Consulting’s newly-released report on the segment, which shines a light on the shifting consumer landscape.

2020/8/31

18 Aug 2020 - The global home audio category posted an unexpected strong performance in Q2 2020, delivering 20% shipment growth and 10% value growth quarter-on-quarter, according to preliminary results from Futuresource Consulting’s latest quarterly tracker. This outcome contradicts industry interviews carried out in March and April, which unanimously suggested Q2 would be significantly worse than Q1. As well as the market growing quarter-on-quarter, volume has also outperformed Q2 2019.

2020/8/31

14 Aug 2020 - The global headphones market held up better than anticipated in the period April-June 2020, as units and prices fared relatively well, particularly from mid-May. That’s according to the latest preliminary quarterly tracker results from Futuresource Consulting, which reveals a 13% year-on-year increase in value for Q2. The research also confirms that units posted an 8% year-on-year contraction for the quarter, better than expected.

2020/7/31

1 July 2020 - Video conferencing solutions continue to move into the commercial foreground, with video conferencing hardware achieving pre-COVID-19 volume and value growth of 28% and 9% respectively in 2019, according to a new report from Futuresource Consulting. The report, which covers all aspects of video conferencing hardware, combines desk research, sales data from vendors across seven key geographies, and channel interviews carried out by Futuresource in the US, France, Germany, and the UK.

2020/6/30

Gaming headsets and accessories have seen a boost in demand during the first half of 2020, new research from Futuresource Consulting has shown. With social distancing measures increasing demand for communication equipment both from the virtual office and in the virtual playground, gaming headsets are one bright spot for the technology market in 2020.

2020/5/31

15 May 2020 - The global headphones market has posted a strong Q1, achieving revenues of $7.2 billion and year-on-year growth of 22% despite the impact of Coronavirus. That is according to the latest figures from Futuresource Consulting, as the firm releases its preliminary quarterly worldwide headphones tracker results.

2020/5/31

14 May 2020 - Smart speakers are driving the home audio market forward, leading to Amazon and Google taking top spots in the brand share rankings according to newly released data from Futuresource Consulting’s Worldwide Home Audio tracker. That is despite the supply chain challenges and disruption caused by COVID-19, which has applied downward pressure on the overall home audio market, resulting in devices without a built-in voice assistant declining more than 20% year-on-year.

2020/4/30

08 Apr 2020 - Streaming subscriptions remain the number one growth driver in the global music market, accounting for more than 70% of spend on music last year. Yet, as measures to halt the spread of COVID-19 begin to reshape the lives of consumers, music streaming is experiencing a temporary drop in consumption.

2020/4/14

14 Apr 2020 - The latest Worldwide Media Box report by Futuresource Consulting explores the future prospects for the media streamer and set-top box (STBs) market, as consumer demand gradually shifts away from traditional Pay-TV toward more flexible SVoD services.

2020/3/31

11 Mar 2020 - The global headphones market continues to capture consumer attention and attract spend, with year-on-year shipment growth exceeding 25% in Q4 2019, according to the latest quarterly tracker from Futuresource Consulting.

2020/2/29

11 February 2020 - Low-latency AV over IP (AVoIP) solutions are on the rise across a range of key verticals, presenting clear advantages over competing technologies. Yet the technology continues to struggle to achieve mass market acceptance. Adam Cox, Senior Analyst at Futuresource Consulting explores some of the challenges and takes us through the detail.

2020/1/31

27 January 2020 - The digital camera market experienced a challenging year in 2019, with global shipments expected to drop 20%, according to a new industry report from Futuresource Consulting. However, the report notes that demand for premium devices is on the rise, taking some of the downward pressure off trade values.

2020/1/31

07 January 2020 - The VR headset market continues to expand, with volumes increasing by 5% in 2019, according to a

new

market report from Futuresource Consulting.

While VR headset sales growth slowed during 2019, the outlook is positive.

2019/12/31

18 Dec 2019 - The market for virtual assistants (VAs) continues to illustrate strong positive momentum, according to a new report from Futuresource Consulting. Shipments of virtual assistants rose 25% year-on-year to 1.1 billion units in 2019, with the market on course to exceed 2.5 billion shipments by 2023.

2019/11/28

21 Oct 2019 - Household refrigeration and laundry appliances are on track to ship 326 million units worldwide in 2019, with smart appliances accounting for a growing share of the market, according to a new summary report from Futuresource Consulting.

2019/11/28

15 Nov 2019 - Wearable tech continues to gather pace, building an ecosystem of connected devices and capturing consumer attention to the tune of $108 billion by 2023, according to a new industry report from Futuresource Consulting.

2019/10/31

17 Oct 2019 - The gaming accessories market continues its ascent, with 76 million units shipped worldwide in 2018, according to a new industry report from Futuresource Consulting. That’s an increase of 22% on 2017, generating a retail value of US$3.1 billion from a combination of headsets, speakers, keyboards and mice.

2019/10/31

26 Sept 2019 - Voice assistants are enjoying widespread adoption within smart devices, personal electronics and speakers, but their usage in-car has garnered relatively little attention.

2019/9/25

11 Sep 2019 - The global LED display market continues to expand, achieving revenues of $6.5 billion in 2018, a rise of 22%, according to a new industry report from Futuresource Consulting.

2019/8/31

09 Aug 2019 - The worldwide home audio hardware market grew 20% last year to reach 154 million units, with a further 19% growth projected in 2019, according to a new market report from Futuresource Consulting. The sector, which includes wireless speakers, soundbars, A/V receivers, Hi-Fi systems and dedicated speaker docks, also witnessed 5% revenue growth last year, with trade values reaching $14.5 billion.

2019/8/31

07 Aug 2019 - Uptake of smart home devices continues apace and is on track to ship 137 million units in 2019, worth $16 billion in trade value, according to a new market report from Futuresource Consulting. That represents a 37% volume increase on 2018, with a slowdown in home hub sales being eclipsed by accelerating growth in other categories.

2019/7/31

22 Jul 2019 - The market for virtual assistants (VAs) shows strong positive momentum, driven forward by a combination of rising consumer demand and improvements in the enabling technologies. According to a new report from Futuresource Consulting, global shipments will exceed 2.3 billion units by 2023, up from a projected 1.1 billion for 2019, with a CAGR of 20% over the reporting period.

2019/6/30

11 Jun 2019 - China’s interactive displays market continues to thrive, with last year’s sales closing in on 1.3 million units, according to a new Global Interactive Displays report from Futuresource Consulting.

2019/6/30

10 Jun 2019 - Consumer spend on gaming software continues to grow, achieving $132 billion, including mobile, PC and console games worldwide in 2018, according to a gaming trends market report from Futuresource Consulting.

2019/7/31

22 Jul 2019 - The market for virtual assistants (VAs) shows strong positive momentum, driven forward by a combination of rising consumer demand and improvements in the enabling technologies. According to a new report from Futuresource Consulting, global shipments will exceed 2.3 billion units by 2023, up from a projected 1.1 billion for 2019, with a CAGR of 20% over the reporting period.

2019/6/30

11 Jun 2019 - China’s interactive displays market continues to thrive, with last year’s sales closing in on 1.3 million units, according to a new Global Interactive Displays report from Futuresource Consulting.

2019/6/30

10 Jun 2019 - Consumer spend on gaming software continues to grow, achieving $132 billion, including mobile, PC and console games worldwide in 2018, according to a gaming trends market report from Futuresource Consulting.

2019/5/31

1 May 2019 - A new study carried out by Futuresource Consulting gauges the size of the higher education sector in North America and Western Europe and analyses how computing devices and related technologies are employed.

2019/4/30

26 Apr 2019 - Home audio equipment shipments continue to climb, growing globally by nearly 20% year-on-year in Q4 2018, according to the Home Audio Tracker Report from Futuresource Consulting.

2019/3/29

19 Mar 2019 - The worldwide media box market, comprising set-top boxes (STBs) and media streamers, is forecast to achieve shipment growth of 1% in 2019, according to a new industry report from Futuresource Consulting.

2019/3/29

06 Mar 2019 - The global headphones market continued its meteoric rise in Q4 2018, with revenue growth outpacing unit shipments by a substantial margin, according to new quarterly figures released by Futuresource Consulting.

2019/2/28

28 Feb 2019 - Wearable technology continues to capture the interest of consumers and is riding an upward trend, with close to 105 million wearables shipped in 2018, a year-on-year increase of 10%, according to the latest Wearable Technology market report from Futuresource Consulting.

2019/2/28

26 Feb 2019 - MWC 2019 is in full flow in Barcelona, with foldable phones making their presence felt in news reports, and prototypes from a range of manufacturers stealing the show.

2019/1/31

The worldwide home audio market realised an increase of 21% in units in 2018, whilst posting revenues of nearly $15 billion, according to year-end estimates from a new Futuresource Consulting report.

2019/1/31

The recent uptake and demand for devices featuring voice assistants has continued to surge, according to findings from Futuresource Consulting’s new Voice Assistants in Home Electronics market report. Futuresource’s latest findings for home CE with voice assistants ‘built in’ showed 119 million devices were shipped worldwide in 2018.

2018/12/31

The global headphones market enjoyed an upsurge in revenues in Q3 this year, growing by 26% year-on-year, according to the latest quarterly tracking report from Futuresource Consulting.

2018/12/31

As 2018 draws to a close, consumer interest in 4K UHD continues to climb, receiving a further push due to average retail prices reaching parity with HDTV sets, according to the latest market tracking report from Futuresource Consulting.

2018/11/30

VR gaming and head mounted displays (HMDs) continue to experience rapid innovation in a stuttering market, amid a range of challenges and a turbulent hype cycle.

2018/11/30

The video gaming headset market is on track to grow more than 50% this year, achieving a global market value of $1.2 billion, according to a new industry report from Futuresource Consulting.

2018/10/31

30 Oct 2018 - As the automotive and entertainment worlds continue to converge, with next generation driving technology firmly at the wheel, Futuresource Consulting explores the trends and developments in its comprehensive new automotive market report.

2018/10/31

30 Oct 2018 - 2018 will be the year 4K UHD moves mainstream, accounting for nearly 50% of all TVs shipped worldwide by year end, according to a market tracking report from Futuresource Consulting.

2018/9/30

05 Sep 2018 - Sales of Mobile PCs* into the K-12 education sector continue to rise in H1 2018, with annual shipments growing 4.6% year-on-year in the second quarter, reaching 6.5 million units, up from 5.5 million in the same period last year.

2018/9/30

30 Aug 2018 - We are experiencing exciting times across the mobile technology market, most notable the smartwatch category, which is witnessing a hotbed of diversification and innovation.

2018/8/31

31 Aug 2018 - Worldwide volume demand for dedicated consumer video devices, such as action cameras, remained resilient in 2017. Futuresource’s new ‘Dedicated Consumer Video Device Market Report’ details how the demand for action cameras continues to be driven by sports enthusiasts, and more increasingly, casual users.

2018/8/31

31 Aug 2018 - The global home audio market continues to climb, with hardware shipments increasing by 23% in 2017, according to a comprehensive new report from Futuresource Consulting.

2018/7/31

05 Jul 2018 - The explosion of Voice Assistant (VA) technology in the consumer segment has been phenomenal, with 37 million units of smart speakers installed worldwide as of end 2017.

2018/7/31

2 July 2018 - The latest quarterly worldwide wearables market report is now available from Futuresource. It highlights game-changing dynamics across this market landscape, which shipped 24.3 million devices in Q1 2018, generating a total market retail value of US$4.4 billion.

2018/6/18

07 Jun 2018 - The latest quarterly update on the worldwide audio market is now available from Futuresource Consulting and states that 'home audio' shipments, including wireless speakers, soundbars and hi-fi systems, grew by 25%, accumulating a total of 27 million units during January to March 2018.

2018/6/18

05 Jun 2018 - Although the first match day is just over a week away, the impact of the promotional sell-in activity surrounding the World Cup is already being felt in the projector market. Feedback from the channel, across both sides of the Atlantic, suggest that brands are 'making hay while the sun shines' with regard to the World Cup, heavily publicising recent price drops of the 4K and 1080p solutions.

2018/5/30

15 May 2018 - Futuresource Consulting has announced the availability of its brand new 'Corporate End-User Study', which highlights the opportunities for an ever-broadening range of suppliers to the this rapidly evolving and developing market sector.

2018/5/30

31 May 2018 - News reports of experiential location-based virtual reality (LBVR) in shopping arcades, theme parks and movie theatres are taking the global press by storm. Companies including FoxNext, Zero Latency and Disney's ILMxLab with Star Wars are demonstrating that LBVR is a viable business for investment, which is clearly enticing mainstream consumers to satisfy their VR curiosity.

2018/4/30

As Google and Amazon continue to jostle to position themselves as providers of the leading smart home voice control device, Futuresource Consulting delivers its fourth timely consumer survey.

2018/4/30

Consumer demand for TV sets is poised to return to growth in 2018, according to the latest Worldwide TV Market Report from Futuresource Consulting.

2018/3/31

08 Mar 2018 - Voice Assistants (VAs) are being integrated into an increasing number and variety of connected consumer devices in multiple markets and are on course to develop as a major user interface over the next 2-3 years, according to the latest Futuresource Consulting Report 'Voice Assistants in Consumer Electronics'.

2018/3/31

06 Mar 2018 - Global sales of Mobile PCs into the K-12 market increased in 2017, with annual shipments growing 11% year-on-year, reaching 29.2 million units, up from 26.3 million in 2016.

2018/2/28

22 Feb 2018 - According to the latest research from Futuresource Consulting, software spend across all gaming platforms (mobile, PC and console) and regions reached $116 Billion in 2017, with mobile accounting for $46 billion. This is expected to exceed $60 billion by 2022, with China anticipated to drive growth and account for almost a fifth of global mobile gaming revenue.

2018/2/28

28 Feb 2018 - At the beginning of 2017, VR (Virtual Reality) was course to enjoy widespread adoption. However, during the year device sales fell short of expectations, according to the latest findings from Futuresource Consulting's latest VR quarterly tracker.

2018/2/28

19 Feb 2018 - The overall US video and Pay-TV market continues its healthy overall growth and is set to reach $140 billion by the end of 2018, according to the latest video entertainment report from Futuresource Consulting.

2018/1/31

09 Jan 2018 - Wireless speakers accounted for three in every four shipments across the entire home audio hardware category in 2017, according to global end-of-year estimates released by Futuresource Consulting.

2018/1/31

03 Jan 2018 - Connected refrigerators and washing machines more than doubled in sales in 2017 and are on course to represent more than half of the global market by 2021, according to Futuresource Consulting's latest Worldwide Home Appliance Market report.

2017/12/31

06 Dec 2017 - Following multiple years of strong double-digit growth, the market for Mobile PCs* into the US K-12 education sector is showing signs of maturity, as penetration is starting to reach relatively high levels. Quarter three saw market volumes grow just 3.5% year-on-year.

2017/11/30

30 November 2017 - Futuresource Consulting has published its comprehensive annual report on the state of the worldwide consumer electronics landscape, revealing worldwide CE sales grew 0.3% in 2016 to reach $673 billion at trade level, on track to achieve 1.7% CAGR to 2021.

2017/10/31

04 Oct 2017 - Smart home devices are shaking off their novelty image and moving mainstream to become one of the fastest growing consumer electronics categories of 2017.

2017/10/31

20 Sep 2017 - Voice enabled 'smart' speakers are driving global home audio sales upwards, despite a softening in demand for non-smart speakers and soundbars and a decline in sales of hi-fi systems, per Futuresource Consulting's latest Home Audio Quarterly Tracker.

2017/9/28

20 Sep 2017 - Futuresource Consulting has published its worldwide headphone quarterly tracker and the latest figures indicated that shipments rose to 80.2 million units in the second quarter of 2017, helping drive retail revenues up 28% year-on-year.

2017/9/28

05 Sep 2017 - Subscription Video on Demand (SVoD) is maintaining its momentum, with Netflix and Amazon continuing to lead the charge in the first half of 2017, despite increased maturity. This is according to the latest biannual 'Living With Digital' consumer research report from Futuresource Consulting covering the USA, Canada, UK, Germany, France, Italy, Spain, Australia and Japan.

2017/8/30

Augmented reality (AR) and mixed reality (MR) presents many opportunities for application enhancement and new monetisation opportunities, but the technologies are still a long-way from being an everyday feature of consumers' lives, according to Futuresource's latest industry tracking report for AR and MR in mobile.

2017/8/30

A new report from Futuresource Consulting shows the home audio market continues to outpace the wider home electronics market.

2017/7/31

The allure of smart speakers continues to attract the attention of consumers, bucking the wider audio market's slowdown and even reinventing Amazon as the world's largest audio equipment vendor. However, that's just the beginning of a wider market transformation, with voice personal assistants (VPAs) at the heart of a new CE land grab, according to a comprehensive new market report from Futuresource Consulting.

2017/7/31

The smart home is poised to emerge by stealth as consumers who install their first device will be keen on automating further, according to the latest Futuresource consumer research.

2017/6/30

Immersive technologies are creating whole new EdTech worlds and opportunities for learning, yet monetisation models need to be established.

2017/6/30

The global video games software market will exceed $100 billion this year, driven by phenomenal growth of both mobile and PC and new console launches from all three of the major players providing stimulus to the category finds Futuresource Consulting in its new GAMES INSIGHTS: Global Video Games Market Report. Consumer spending on mobile gaming will account for half ($45 billion) of all digital gaming software revenues this year as smartphone and tablet install bases are increasingly reaching their peak in developed countries, and developing nations growth is exploding.

2017/5/31

4K UHD TV sales are poised to grow by a further 38% in 2017 to account for more than a third of the worldwide TV market, according to latest projections from Futuresource Consulting.

2017/5/31

Innovative technologies for displaying TV content without the glass oblong or staid grey box are set to offer consumers a new viewing concept and a fantastic opportunity to re-invigorate living room design, according to 'A Review of the Global Screenless TV Market' report released by Futuresource Consulting.

2017/4/30

The home appliances sector accelerated in 2016, as global shipments grew by 4% to 247 million refrigeration and laundry units according to the latest 'Worldwide Home Appliance Market Report' published by Futuresource Consulting. Continued volume growth is expected over the next five years, for a market that is worth $85 billion a year.

2017/4/30

Smartphones which unfold to become tablets, adjustable curved TVs and pop-up presentation screens are just some of a radical new wave of product concepts made possible by advances in flexible display technology, highlighted in the latest research report from Futuresource Consulting.

2017/3/31

The education technology landscape is rapidly evolving. The adoption of mobile PC's in classrooms, the digitisation of content, a growing reliance on cloud services and a high penetration of smart devices amongst parents, teachers and students are just some of the catalysts for change.

2017/3/31

Audio hardware continues to outpace the wider CE sector, with global Q4 sales growing 28% year-on-year to $10.2 billion, according to new data from Futuresource Consulting's quarterly audio tracking service.

2017/2/15

Sales of wireless audio devices and headphones are already booming – and there’s much more growth in prospect as a result of developments such as Voice Personal Assistant (VPA) speakers and feature-rich headphones, according to research from Futuresource Consulting.

2017/2/15

Futuresource Consulting has recently released its annual evaluation of the health and shape of global home video entertainment, detailing the macro trends of 2016, in addition to insights for 2017 and beyond.

2017/1/31

CE market revenues returned to growth in 2016, following 2015's 'blip'. Growth was modest, however, at 1.2% (to reach $680 billion), as 'emerging' markets faltered, mobile revenues slowed and categories such as small-screen TV's and cameras continued to be squeezed by convergence.

2017/1/31

Futuresource Consulting has recently released its annual evaluation of the health and shape of global home video entertainment, detailing the macro trends of 2016, in addition to insights for 2017 and beyond. This latest analysis highlights that households are spending more than ever before on video entertainment, and in 2016, the combined home video and Pay-TV market totalled $251.5 billion, up by 3% comparative to 2015

2016/12/31

After a 2% decline in worldwide TV shipments last year, 2016 is showing signs of a turnaround, with the market flattening out to end the year on 225 million units, achieving a value of $86 billion according to a new report from Futuresource Consulting.

2016/12/31

Futuresource Consulting has published its latest 4K report highlighting industry momentum for the adoption of 4K Ultra High Definition (UHD). Consumer electronics manufacturers are rolling out a greater range of capable devices at mass market prices.

2016/11/30

Futuresource has recently published the latest findings from the 6th wave of Kids Tech. Its consumer research programme specifically focused on children aged 3 through to 16 across USA, UK, Germany & China, providing ongoing monitoring of their digital media consumption and its influence on their habits and interests.

2016/11/30

Voice recognition technology is shaking up the CE industry, broadening the horizons of speaker vendors and reinventing the audio device as the gatekeeper of voice, smart home and machine learning.

2016/10/31

Futuresource Consulting projections of a difficult year for the sales of personal computers into the K-12 education sector* are looking correct with the status of several large scale national tenders uncertain due to unstable economic and political conditions.

2016/10/31

Smart home automation, smart appliance ownership and smart home surveillance could be primed and ready for growth, though progress is being hindered by widespread confusion, according to a comprehensive new consumer research report from Futuresource Consulting.

2016/9/14

With the consumer electronics (CE) show IFA now in full swing, Futuresource Consulting would like to highlight the importance that voice will play in next generation CE products.

2016/9/14

Futuresource Consulting has announced the release of a new worldwide drone market report, which addresses the potential for the overall drone market, with an in-depth look into the key trends, opportunities and barriers across the video, toy and specialist drone markets.

2016/8/31

Despite the numerous and varied factors impacting the projector market, Futuresource continues to predict the development of volume sales with supreme accuracy.

2016/8/31

Futuresource Consulting's latest review of the long term outlook for the worldwide consumer electronics market highlights the challenges and opportunities that face the industry following a year that saw trade value fall by 1.3% to $676 billion.

2016/7/31

Futuresource Consulting has published its latest worldwide digital media adaptor (DMA) report to provide a comprehensive insight into the media streaming device market. 2015 saw shipments of 42 million DMAs,

2016/7/31

Futuresource Consulting has announced the latest results from its worldwide audio equipment tracking service, which states that in 2015, worldwide demand for home audio products grew by 24% to 88.2 million units, whilst trade value remained stable at $9.8 billion.

2016/6/30

With E3 now upon us, Futuresource Consulting has recently published its Global Video Games Market Report, which complements the anticipated key themes from the show. It also provides a benchmark for current market performance, sizing and trends together with an outlook to 2020 on a global and regional basis. As part of this, it highlights growth opportunities, which are anticipated to be reflected by announcements that Futuresource expects to see at #E32016.

2016/6/30

Futuresource Consulting – London is projecting a difficult year for the sales of personal computers into the K-12 education sector*, with the status of several large scale national tenders uncertain due to unstable economic conditions.

2016/5/31

The consumer photo printing market is changing before our eyes. In the last couple of years the traditional digital and film print market has seen, a yearly, double digit decline. In 2015, the consumer photo print market in Western Europe fell, in value terms, by 4.7%. Conversely, today we see it stabilise through digital disruption, in the positive sense.

2016/5/31

New research from Futuresource Consulting reveals that the worldwide headphones market enjoyed another year of robust volume and price growth in 2015. Shipments grew 7% to reach 331.3 million units, while retail value surged by an impressive 19% to $11.2 billion.

2016/4/30

Futuresource Consulting has released its latest worldwide TV market report which states that shipments of 4K Ultra High Definition (4K UHD) sets grew by almost 160% in 2015 to total 32 million units, equivalent to 14% of all sets sold. This is expected to rise to almost 140 million by 2020, by which time 4K UHD shipments will command 52% of the market.

2016/4/30

Futuresource Consulting, the leading provider of education technology research, has published its annual strategic technology in education report, delivering a fully-comprehensive view of the global education landscape.

2016/3/31

Futuresource Consulting is about to release its latest Global Wearables Q4 2015 results, which highlights that 99 million devices were sold across all categories, growing by 76% year-on-year. Retail value was $24bn, increasing by 267% from the previous year, highlighting a marginal increase in the overall average selling price per device.

2016/3/31

7th March 2016 – London - Adoption of personal computers within the K-12 education sector continued to increase across 2015, with shipments of devices rising more than 12% globally according to the recently published Futuresource Consulting 'Personal Computing in K-12 Education – Q4 2015 Market Track' report. Global shipments reached 29.6 million units in 2015, up from 26.4 million in 2014.

2016/2/5

The Futuresource Professional Display team is all set to explore the halls of the Amsterdam RAI exhibition centre to scope out what is on offer at The Integrated Systems Europe 2016 (#ISE2016) during the 9th to the 12th February.

2016/2/4

Futuresource Consulting has announced the publication of its new Virtual Reality (VR) Report titled 'Virtual Reality – Niche or Mass Market?' This review provides unique user and consumer insight data, as well as presenting a kaleidoscopic view of the barriers, drivers and ecosystems that should be considered when evaluating investment in this market place and understanding what key factors will take this technology from niche to mass market.

2016/1/31

According to the 2016 System & Box Camera Market report from Futuresource Consulting pro camcorders are increasingly competing with system cameras in the studio environment due to CAPEX savings.

2016/1/31

According to the latest report issued by Futuresource, the worldwide population of photographers has grown by a factor of 8 over the last 10 years, to more than 4 billion, while the number of photos captured annually has increased 6-fold to 1.2 trillion.

2015/12/30

Futuresource Consulting will this week be going to field with its latest wave of consumer research focusing on kids between 3 and 12 years old, highlighting patterns and insight into technology usage and entertainment content consumption in the USA, China, Germany and UK.

2015/12/30

According to the latest Futuresource Consulting Education-Tech K-12 Market Report*, Microsoft and its Windows Operating System (OS) is poised to raise its game in the fight for adoption and market share in the worldwide K-12 PC/Tablet market in 2016.

2015/11/30

Innovative, cutting edge technology and what it means to consumer entertainment continues to be on the forefront of the agenda at Futuresource Consulting as it announces the imminent release of its latest report covering Virtual Reality (VR) and Mixed Reality (MR).

2015/11/30

The latest Futuresource Headphones Market Report provides not only a snapshot of the current trends and forthcoming evolutions in headphone technology but also serves as a tip top guide for Christmas tech gadget shopping.

2015/10/31

Photo printing seems like a long-forgotten exercise for many and, for others, it's something that they are too young to have grown up with.

2015/9/11

The truly immersive experience of VR is opening up new markets for various industries to diversify and integrate into.

2015/9/11

The interactive whiteboard market has grown at a tremendous pace over the last decade. Initially major uptake was in the UK, Mexico and the USA, but they have now become common place across the globe.

2015/7/31

According to the worldwide TV market report from Futuresource Consulting, 4K TV shipments are expected to grow by 147% in 2015, despite overall 2% fall in TV sales.

2015/7/31

According to the latest report from Futuresource Consulting, the broadcast (linear) encoder markets are due to decline over the next five years. Revenues are expected to decline by 21% in the distribution market and by 10% in the contribution market.

2015/7/31

According to the latest Worldwide Home Audio Market report from Futuresource Consulting, the home audio market (Wireless Speakers, Soundbars, Hi-Fi Systems, A/V Receivers and Speaker Docks) grew by 22% to ship 71 million units.

2015/7/31

According to the latest report issued by Futuresource Consulting, the worldwide action camera market grew by 44% year on year in 2014, reaching 7.6 million units, with a retail value of $3.2 billion.

2015/6/17

According to the latest Worldwide Tablet Report from Futuresource Consulting the emergence of low-cost Android devices are causing a dilution of Apple's market share. The introduction of lower-priced iPads, and the aggressive PC brand pricing strategy has made the average tablet price fall dramatically between 2010 and 2014.

2015/6/17

Futuresource Consulting has continued its decade long study and released the fifth edition of the global videowall report which explores the adoption rates of technologies in the tiled display market.

2015/5/12

According to a new report by Futuresource Consulting, worldwide shipments of headphones grew by 8.5% in 2014 to 309.5 million units.

2015/5/12

Futuresource Consulting has just released its latest smart home report, which maps out the smart home landscape. The report identifies the key drivers, such as security, that are shaping demand and assesses the likely impact these drivers will have on the expanding consumer markets.

2015/4/27

Futuresource, UK, 9 April 2015 - is announcing the release of the global wearable technology report highlighting how the market for wearable technology was worth over $8.9bn in 2014, with 56 million devices shipped in the year. Here are some highlights from the latest research:

2015/4/27

Futuresource Consulting, UK, April - Futuresource Consulting has announced the release of the Video Insights series, a collection of market reports that map out and assess the current and future trends across the video entertainment landscape, highlighting latest market trends, challenges and opportunities across Australia, Italy, Russia, Turkey, UK and USA.

2015/3/10

Despite the increased focus on PCs and tablets, interactive display value is growing due to a strong transition to higher priced interactive flat panels, which accounted for over 1/3rd of the market in 2014, according to the latest research from Futuresource Consulting.

2015/3/10

Futuresource, UK, 1 March 2015 – According to the latest report from Futuresource Consulting, the market for mobile computing devices in the compulsory education sector (K-12) has risen by 18.3%, with the number of devices shipped into K-12 education globally in Q4 2014 amounting to 5.7million.

2015/2/16

Futuresource Consulting's latest wave of Living with Digital consumer research highlights the continued shift in entertainment behaviour amongst respondents. One key trend is the emergence of TV as an increasingly connected device, either directly on the connected TV or through ancillary devices such as digital media adaptors (DMA) or connected set-top-boxes, both of which have emerged as very important devices.

2015/2/6

With International CES well underway and a team of Futuresource analysts walking the halls and reporting their findings in breakfast webinars, this release is the first in a series that explores some of the key technologies on show and provides Futuresource market forecasts for the relevant CE segments.

2015/1/13

The worldwide television market is forecast to grow to 234 million units in 2014, representing a 3% growth from 2013, according to the latest research from Futuresource Consulting.

2014/12/18

Google's Chromebook platform is the best-selling device in US K-12 education for the second quarter in a row, according to the latest report from Futuresource Consulting on the global uptake of personal computers in K-12 education.

2014/11/19

Smart TV sales reached 90 million units worldwide in 2013 and will grow at 21% CAGR to reach 228 million in 2018, according to a new Smart TV report from Futuresource Consulting.

2014/11/19

Consumer demand for wearable technology is rising fast, with Q3 global shipments totalling 12.7 million units, up 40% from just over nine million units in Q3 2013, according to the latest quarterly research from Futuresource Consulting.

2014/10/31

The global headphones market expanded by nearly 10% in volume last year to reach 286 million units shipped, triggering 16% growth in retail value and revenues of $8.4 billion, according to a new market report from Futuresource Consulting.

2014/10/31

Uptake of personal computers in the global K-12 education market is growing apace, with competition between different form factors intensifying, according to the latest edition of Futuresource Consulting's K-12 Education Technology Market Track study.

2014/9/5

Competition between different personal computing devices and form factors is hotting up within the US K-12 education market as districts and schools continue to purchase personal computers for students and teachers.

2014/9/5

Interactive whiteboards and interactive flat panel displays in the education and corporate sectors achieved close to 270,000 unit sales in Q2 2014, a similar volume to Q2 last year and a good pick up after a quiet Q1, according to the latest quarterly research from Futuresource Consulting.

2014/9/5

The global pro camcorder market enjoyed a buoyant first half of 2014 with an overall increase of 5% (7,000 units) from H1 2013 to reach a total of 149,000 units, according to the latest pro camcorder tracking report from Futuresource Consulting.

2014/9/5

Paid-for streaming music subscription services have experienced significant growth in both the USA and key markets in Western Europe, with paid-for subscribers in these territories expected to double to over 20 million in 2014 compared to 2012, according to the latest research from Futuresource Consulting.

2014/9/5

Global smartphone unit shipments were up 50% in 2013, exceeding one billion units, and on target to surpass 1.2 billion shipments in 2014, according to the latest research from Futuresource Consulting.

2014/8/20

Global projector shipments grew a staggering 17% in volume YoY in Q2, to two million units and in value terms the market grew 9% to hit $2.4 billion, according to the latest quarterly research from Futuresource Consulting.

2014/8/20

Global STB (Set-Top-Box) shipments in 2013 remained relatively stable, despite competition from other devices such as Smart TVs and Digital Media Adaptors, according to the latest research from Futuresource Consulting.

2014/8/20

The overall US video entertainment market (subscription Pay-TV, box office, packaged home video, Pay-TV VoD and paid-for online video) continues to grow in low single digits, reaching $120 billion in 2013 - a 2% increase on 2012 - and is on track to peak at $123 billion in 2015, according to the latest industry report from Futuresource Consulting.

2014/7/28

Worldwide demand for action cameras reached almost 5 million units in 2013 - which represented annual growth of 47% - and on track to reach 9 million units in 2018, according to the latest research from Futuresource Consulting.

2014/7/16

It's easy to get carried away with the idea that the increased availability of technology, broadcast programming and digital content has radically changed the make-up of children's playtime and altered overall habits for device usage and media consumption.

2014/7/16

The photo prints market continues to make up the lion's share of revenues within the European photo industry, last year generating revenues at retail that were 130% the size of the photobook and photo-merchandise markets combined, according to the latest research from Futuresource Consulting.

2014/6/20

The global spend on education technology within classrooms reached US$13 billion last year, up 11% on 2012, according to a new market study from Futuresource Consulting, the leading provider of education technology research.

2014/6/20

The videowall market maintained its strong growth trajectory in 2013, posting nearly 60% CAGR from 2009 to 2013 to reach sales of 449,000 units, according to a new industry report from Futuresource Consulting.

2014/5/14

Overall video entertainment spend in the UK is expected to reach ツ」10 billion by 2018, averaging 2% annual growth between 2014 and 2018. Pay-TV and subscription VoD services will be the key drivers, with transactional digital video showing moderate growth.

2014/5/14

Overall consumer spend on video and TV entertainment in Mexico grew by 9% in 2013 to reach USD$4.2 billion (54.5 billion pesos) and is forecast to reach USD$4.5 billion (58.8 billion pesos) in 2014, according to the latest research from Futuresource Consulting.

2014/5/14

After a weak performance from the global TV set market in 2013 - with revenues and shipments down 4% and 2.6% respectively - the segment is expected to return to growth in 2014, according to a new strategic report from Futuresource Consulting.

2014/4/14

Worldwide shipments of professional flat panel displays increased by 8% quarter-on-quarter in CYQ4 2013 to reach 567,000 units and finish the year with 20% volume growth, according to the latest research from Futuresource Consulting.

2014/4/14

Worldwide shipments of front projectors grew reasonably year-on-year by 6% to 2.12 million units in CYQ4 2013, representing $2.63 billion in value, according to the latest research from Futuresource Consulting.

2014/3/24

Global sales of interactive whiteboards and interactive flat panel displays in the education and corporate sectors reached 1.3 million units in 2013, up 1% on the previous year and making it the largest year on record, according to the final 2013 quarterly research report from Futuresource Consulting.

2014/2/24

The Western European consumer photobook market is on track to achieve unit sales of almost 27 million units in 2014, according to the latest photobook research from Futuresource Consulting, up from an expected 25 million in 2013.

2014/2/24

The global* pro camcorder market remained stable in 2013 with a decrease of less than 1% from the previous year, to reach 289,000 units in total, according to newly released figures from Futuresource Consulting. However, the end of year data shows that the stability of the overall market hides very different regional pictures.

2014/2/7

The global installed base of TV-centric connected devices surpassed one billion units in 2013 and will exceed two billion by 2017, driven by smart TV, IP-enabled set top boxes, game consoles, Blu-ray players and low cost digital media adapters, according to the latest research from Futuresource Consulting.

2013/12/20

Global penetration of mobile computing devices within K-12 education is forecast to reach almost 10% by the end of 2017, growing from just over 3% in 2012, according to Futuresource Consulting's quarterly tracking service 'Mobile Computing in Education'.

2013/12/20

The consumer wearable electronics segment - comprising wireless and smartwatches, activity trackers, wearable GPS, heart rate monitors and smartglasses - is experiencing a period of rapid growth with a forecast value of over $8 billion in 2013, according to the latest research from Futuresource Consulting.

2013/11/18

Action Camera sales in Europe are on track to grow 矜ャア17 million in 2013, to reach 矜ャウ61 million and are forecast to continue the strong growth for the next five years according to a new report from Futuresource Consulting.

2013/11/18

The worldwide AV headphones market is on track to ship 284 million units this year, equivalent to growth of 9% over 2012, with revenues forecast to reach $8.2 billion according to new research from Futuresource Consulting

2013/11/18

The smartphone market continues to see rapid growth worldwide, reaching 919 million units in 2013, representing a growth rate of 29% from 2012 and total mobile handsets grew 6.9% to reach 1.7 billion units. Also in 2013 for the first time, shipment volume of Smartphone handsets will overtake the number of standard handsets shipped and this trend will continue through to 2017.

2013/10/31

2013 is expected to be a landmark year for digital gaming, with the launch of Sony's PlayStation 4 and Microsoft's Xbox One, together with the growing role of non-dedicated gaming platforms, as the boom in smartphone and tablet adoption continues.

2013/10/1

Consumer uptake of 3D hardware continues apace, with the market on track to achieve 157.7 million 3DTV sales in 2017, up from a forecast of 59.3 million for 2013, according to a new report from Futuresource Consulting.

2013/9/25

50% of people across the UK, Germany, Russia and the USA are using their laptops to share digital images with their family and friends, according to a new consumer research study from Futuresource Consulting.

2013/9/25

With the launch of Xbox One and PS4 confirmed for Q4 this year (Asia 2014), the global packaged console games market will increase by $430 million in retail value in 2014, reaching ツ」18.7 billion according to a new console, handheld and PC gaming market report from Futuresource Consulting.

2013/8/26

August 2013 London, UK-Global Pay TV set top box (STB) shipments continue to grow, with demand expected to peak at 180 million units in 2016, according to new research from Futuresource Consulting.

2013/8/20

For the first half of 2013, sales of interactive whiteboards and interactive flat panel displays in the education and corporate sectors were up 20%, according to the latest quarterly research from Futuresource Consulting.

2013/7/29

The global TV market will return to growth in 2013 after shipments fell by 6% last year, with growth continuing out to 2017 according to a new report from Futuresource Consulting.

2013/6/25

Global shipments of Digital Media Adapters 矚ナ‥evices designed to stream content to the TV from the internet and IP connected devices 矚ナ『ill grow nearly 40% this year, with the market on track to double in size by 2017, according to a new industry report from Futuresource Consulting.

2013/5/1

The external hard disk drive market in EMEA had a difficult first half last year, mainly due to supply chain challenges in 2011, culminating in annual volumes for 2012 falling by 17% to 21.5 million.

2013/4/16

Global sales of mobile computing devices in K12 education exceeded 4.4 million units in Q4, with full year performance for 2012 increasing by 29% to reach 15.6 million, according to the latest research from Futuresource Consulting.

2013/3/6

Worldwide demand for camera accessories including lenses, bags, cases, supports and flashes, reached a trade market value of $5.1bn in 2012, according to a new global industry report from Futuresource Consulting.

2013/2/22

The USA consumer photo-merchandise market grew 18% to over $1.5 billion in 2012 and positive growth is expected to continue with the market developing to over $1.9 billion by 2015, according to the new photo-merchandise market report from Futuresource Consulting.

2013/2/5

Global tablet sales reached 64 million units in Q4 2012, representing quarterly growth of nearly 100% and year-on-year growth of 119%, according to the latest industry research from Futuresource Consulting.

2013/1/21

By Simon Bryant, Head of Consumer Electronics, Futuresource Consulting

Connectivity is rapidly becoming a standard feature across all consumer electronics products and is having a huge impact upon the way that people

access content at home and on the move.

2013/1/17

The total global tablet market exceeded 32 million shipments in Q3 2012, growing 75% year on year, according to a new Tablet Market Update report from Futuresource Consulting.

2012/12/12

For calendar year Q3, sales of interactive whiteboards and interactive flat panel displays in the education and corporate sectors are up 22% year-on-year, according to the latest quarterly research from Futuresource Consulting.

2012/12/6

For calendar year Q3, sales of interactive whiteboards and interactive flat panel displays in the education and corporate sectors are up 22% year-on-year, according to the latest quarterly research from Futuresource Consulting.

2012/11/16

This is the sumamry report from Futuresource Consulting about Global CE Industry.

(PDF download only available)

2012/10/16

Global CE sales rose 6.3% in 2011, to reach $553bn, in spite of a challenging economic climate, saturation in key product categories such as TV, Cameras, and Home Video equipment, and the impact of floods in Thailand and residual effects of Japan earthquake.

2012/9/24

In 2011, the action cam market achieved 24% growth, reaching nearly 1.5 million units shipped, according to a new report from Futuresource Consulting.

2012/9/13

The global AV headphones market is expected to witness growth of 20% in 2012 to reach $6 billion in value, increasing from $5 billion in 2011, according to a new report from Futuresource Consulting.

2012/9/13

Whilst the education sector is not immune to the impact of the economic downturn, it is bucking the downward trends that are currently the norm in other sectors of the electronics market.

2012/8/31

The global video wall industry is experiencing renewed growth, with the market on track to reach 380,000 unit sales in 2012, equating to year-on-year growth of 60%, according to a new industry report from Futuresource Consulting.

2012/8/20

The global TV market is forecast to reach shipments of 239m units in 2012 according to a new TV market tracking report from Futuresource Consulting.

2012/8/10

After a reasonable start to calendar year 2012, the projectors market (excluding pico) had another solid quarter in Q2 2012, bolstered by strong demand in the corporate and home markets of Western Europe as Poland and Ukraine played host to the European Football Championships.

2012/8/1

With total global trade revenues in excess of $100 billion in 2011 and 30% further growth expected in 2012, the smartphone market is on track to become the largest consumer electronics segment in 2012, exceeding that of televisions.

2012/7/3

The games market across the USA and Western Europe is to witness steady growth through to 2015, reaching $15.7 billion and 矜ャア0.2 billion respectively in total retail value, according to new research from Futuresource Consulting.

2012/6/20

The consumer tablet market reached a global total of nearly 19 million units shipped in Q1 2012, growing by 188% from the same period in 2011, according to the latest Tablet Tracking report from Futuresource Consulting.

2012/6/11

Following several years of healthy growth, demand for set top boxes (STBs) continues to climb this year, on track to reach 228 million units shipped globally, according to a new report from Futuresource Consulting.

2012/5/18

Worldwide shipments of soundbars 矚ナ《eparate speaker units containing two or more speakers that are connected to a television - doubled in size between 2010 and 2011 to reach nearly 2.5 million units, with the market expected to enjoy further growth throughout the forecast period to 2016.

2012/5/7

Total global tablet sales including consumer, commercial, industrial and institutional exceeded 64 million units in 2011 and are on track to soar to 232 million units in 2016, according to the latest Tablet Technology and Markets report from Futuresource Consulting.

2012/4/25

The global outlook for 3D continues to be positive across the various entertainment platforms, according to a new strategic report from Futuresource Consulting.

2012/3/28

The mobile apps market has evolved significantly over the last two years, helping improve the range and quality of content available to consumers on their mobile phones, as well as providing opportunities for a whole range of industry segments to reach out to their target audiences and realise new revenue streams, according to a new market report from Futuresource Consulting.

2012/3/8

The global home entertainment sector, both hardware and content, remains fairly resilient in times of economic downturn, and although 2011 was a challenging year it would appear that the industry fared better than many others.

2012/2/20

By 2014, 60% of all home audio shipments across the USA, Western Europe and Japan will feature networking connectivity, according to Futuresource Consulting, rising from forecasts of 10% in 2012 as networking takes over as the major growth area.

2012/2/6

With forecasts exceeding 80% of units shipped by 2015, connected TVs are expected to lead the way in global TV shipments escalating from 27% in 2011, according to new research from Futuresource Consulting.

2012/1/23

London, 05 January 2012 - Futuresource Consulting has released a strategic research report focusing on the opportunities for personal computer devices within the K-12 education sector, showing a compound annual growth rate (CAGR) of 28% for 2011 to 2016.

2012/1/11

Highlighting many similarities in camera ownership and behaviour between consumers in the UK and USA, a new wave of consumer research by Futuresource Consulting looks into image-capturing and photo-sharing behaviours across these two major markets.

2011/12/27

The growing presence of online video has given rise to significant advances in the overall Russian home video market, with uptake in digital viewing triggering market growth forecasts in the region of 1000% in 2011, according to new research from Futuresource Consulting.

2011/12/8

Consumption of legitimate free and paid-for online video is on track to exceed 770 billion views across the USA, UK, France and Germany this year, according to a new report from Futuresource Consulting.

2011/11/17

Nearly 50% of consumers are using another electronic device while watching TV at home, according to findings from a new wave of 矚マュiving with Digital矚ム…onsumer research carried out by Futuresource Consulting.

2011/11/2

This is the sumamry report from the sessions which Futuresource Consulting addressed at the International Business Session of CEATEC JAPAN 2011 Official Conference�(PDF download only available)

2011/10/31

Futuresource has attended CEATEC JAPAN for many years however 2011 marked the first time Futuresource has teamed up with CEATEC JAPAN in an official capacity, as its 'knowledge partner'.

2011/9/28

The continued rise in the consumption of digital content in the home, whether through a laptop, PC, connected TV, games console or Blu-ray player has led to an increased demand for higher speed fixed broadband connections.

2011/9/15

Despite doubts about the world economy, the IFA Consumer Electronics Show in Berlin had a record number of visitors this year, at 238,000. Trade attendees were up 12% on previous years, exceeding 132,000, and nearly 40% of trade attendees came from outside Germany.

2011/9/6

Demand for photobooks from consumers in the USA continues to rise, providing a profitable revenue stream to many companies operating within the sector, with the market growing last year by nearly 25% to achieve in excess of 20 million units sold. Moving forward, this market is on track to make double-digit volume growth again this year and also through into 2012, with Futuresource forecasts predicting 25 million photobooks in 2011 and nearly 29 million in 2012.

2011/8/30

Analogue switch-off and the "eco points" discount scheme have had a massive impact on Japanese TV set demand but it is access to online video services through in-built IP Connectivity that will be key to driving demand in the near future.

2011/8/23

The continuing strong demand for smartphones has revitalised the global handset market, with the smartphone installed base expected to double by the end of 2011, compared with 2009 levels.

2011/8/16

Pure-play (online only) Internet radio and music streaming services continue to experience relatively high consumer usage, although revenue stream development remains key to the future.

2011/8/9

"There are around 10 million televisions being sold each year in the UK - and that's in a country that has just 25 million households," says Jim Bottoms, Director and Co-Founder, Futuresource Consulting, "which means every home is going out and buying a TV every two and a half years."

vol.2152021/1/20

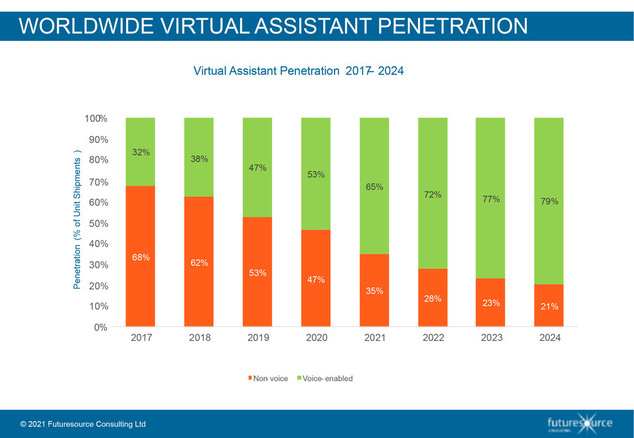

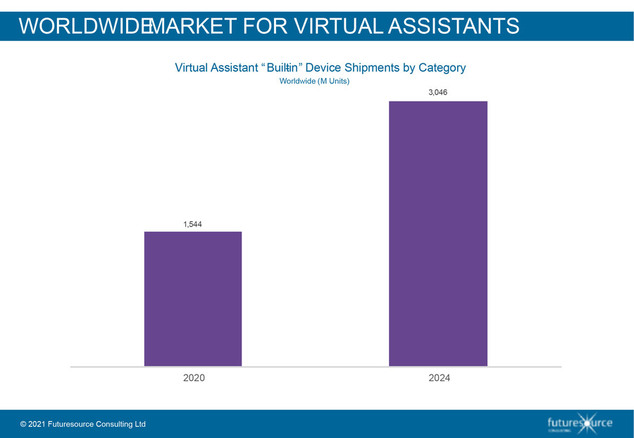

The global market for virtual assistants (VAs) continues to exhibit robust performance, propelled by enhancements in the underlying technologies along with increasing penetration across Consumer Electronics. According to the latest research from Futuresource Consulting, shipments of products with built-in voice assistant technology will double to 3.0 billion units in 2024, representing a CAGR of 19% across the forecast period. The impact of COVID-19 dampened VA shipments throughout 2020; however, the effect of lockdowns on consumer purchasing was less pronounced than anticipated, and 2020 saw a 9% increase in shipment volumes overall.

Apple, Google and Baidu emerged as the top three VA platform vendors by unit shipments in 2020. Apple’s Siri holds 25% share worldwide, reflecting strong sales in Apple iPhone, iPad and Airpods; the newly announced AirPods Max will expand Siri’s opportunity further in 2021. Google Assistant holds 22% share, primarily due to its integration in Android smartphones and tablets, but also now illustrating moderate growth in the wearables category. Baidu hold 14% market share overall, driven by its success in smart speakers and smartphones. The company made moves into hearables, launching XiaoduPods late in 2020; meantime, further collaboration with Huawei promises to widen their market opportunity in 2021.

“Voice control has established itself as an essential feature across consumer electronics,” says Simon Forrest, Principal Technology Analyst at Futuresource Consulting. “The audio processing aspects of virtual assistants have largely matured, and focus has shifted towards improving assistant competency and optimising language models. As such, innovation now lies squarely in the hands of the technology giants with knowhow in artificial intelligence.”

Although virtual assistant technology is continually improving, the gains are becoming harder to quantity and questions are being raised around the efficacy of voice interfaces. “Virtual assistants promise a frictionless way to interact with products and services, yet the industry is still several years away from perfecting ‘voice first’ interfaces and may never become truly independent of screens,” explains Forrest. “Virtual assistants must deliver accurate responses each and every time, otherwise consumer adoption diminishes. So, platform vendors are working to enhance the contextual awareness of their VAs and develop AI capable of surfacing precisely the right results.” VA platform vendors offer tools to assist the evaluation of natural language processing models. While these cannot solve all analytical issues, developers are employing these tools to quantify whether amendments to their AI models actually improve the results, whilst the opportunity for regression testing helps ensure that modifications to interaction models do not degrade the experience.

Platform vendors are moving swiftly to utilise neural network accelerators (NNAs) to place many elements of voice engines at the edge, on devices themselves, to reduce latency and increase privacy. Prime examples of this include the Honghu AI chip jointly developed by Huawei and Baidu, and Amazon’s AZ1 Neural Edge processor, allowing voice algorithms to execute on the device itself, starting with an all-neural speech recognition model that handles requests locally. Moreover, vendors are creating lightweight VA solutions that can run even on small microprocessors, extending the opportunity to place voice into battery-operated devices. “Virtual Assistants are developing beyond simple command and control mechanisms, transforming into platforms with rudimentary conversational ability and intelligent anticipation,” advises Forrest. “In 2021, we expect VA platforms will become capable of participating in conversations and deliver new monetisation opportunities for service providers beyond harvesting data on usage behaviours.”

The market is now changing, with product designers now considering whether the optimum approach might be in using domain-specific assistants. “Domain-specific assistants promise to improve command-based interaction, since it’s easier to map the range of user intents to a limited subset of outcomes, whilst also expanding the number of ways users can make their request,” explains Forrest. Conversely, cloud-based virtual assistants are steadily becoming better at extracting complex intent from voice queries, since they harness the dual benefits of flexible machine learning coupled with massive knowledge banks.

The trend of integrating voice into devices continues. Futuresource predicts that four out of every five consumer electronics products sold will exhibit some form of virtual assistant capability by 2024.