About Futuresource Consulting

Futuresource Consulting, the specialist research and consulting company, is delighted to be the official knowledge partner for CEATEC JAPAN. The company can trace its roots back to the 1980s and provides market insights into consumer electronics, digital imaging, entertainment media, broadcast, optical manufacturing, storage media, professional IT and education technology.

With more than 70 full-time employees providing in-depth analysis and forecasts across consumer and professional electronics categories, Futuresource is able to advise on market, competitive and technological developments, providing clients with access to the information that helps produce the best possible results.

2015/1/13

The worldwide television market is forecast to grow to 234 million units in 2014, representing a 3% growth from 2013, according to the latest research from Futuresource Consulting.

2014/12/18

Google's Chromebook platform is the best-selling device in US K-12 education for the second quarter in a row, according to the latest report from Futuresource Consulting on the global uptake of personal computers in K-12 education.

2014/11/19

Smart TV sales reached 90 million units worldwide in 2013 and will grow at 21% CAGR to reach 228 million in 2018, according to a new Smart TV report from Futuresource Consulting.

2014/11/19

Consumer demand for wearable technology is rising fast, with Q3 global shipments totalling 12.7 million units, up 40% from just over nine million units in Q3 2013, according to the latest quarterly research from Futuresource Consulting.

2014/10/31

The global headphones market expanded by nearly 10% in volume last year to reach 286 million units shipped, triggering 16% growth in retail value and revenues of $8.4 billion, according to a new market report from Futuresource Consulting.

2014/10/31

Uptake of personal computers in the global K-12 education market is growing apace, with competition between different form factors intensifying, according to the latest edition of Futuresource Consulting's K-12 Education Technology Market Track study.

2014/9/5

Competition between different personal computing devices and form factors is hotting up within the US K-12 education market as districts and schools continue to purchase personal computers for students and teachers.

2014/9/5

Interactive whiteboards and interactive flat panel displays in the education and corporate sectors achieved close to 270,000 unit sales in Q2 2014, a similar volume to Q2 last year and a good pick up after a quiet Q1, according to the latest quarterly research from Futuresource Consulting.

2014/9/5

The global pro camcorder market enjoyed a buoyant first half of 2014 with an overall increase of 5% (7,000 units) from H1 2013 to reach a total of 149,000 units, according to the latest pro camcorder tracking report from Futuresource Consulting.

2014/9/5

Paid-for streaming music subscription services have experienced significant growth in both the USA and key markets in Western Europe, with paid-for subscribers in these territories expected to double to over 20 million in 2014 compared to 2012, according to the latest research from Futuresource Consulting.

2014/9/5

Global smartphone unit shipments were up 50% in 2013, exceeding one billion units, and on target to surpass 1.2 billion shipments in 2014, according to the latest research from Futuresource Consulting.

2014/8/20

Global projector shipments grew a staggering 17% in volume YoY in Q2, to two million units and in value terms the market grew 9% to hit $2.4 billion, according to the latest quarterly research from Futuresource Consulting.

2014/8/20

Global STB (Set-Top-Box) shipments in 2013 remained relatively stable, despite competition from other devices such as Smart TVs and Digital Media Adaptors, according to the latest research from Futuresource Consulting.

2014/8/20

The overall US video entertainment market (subscription Pay-TV, box office, packaged home video, Pay-TV VoD and paid-for online video) continues to grow in low single digits, reaching $120 billion in 2013 - a 2% increase on 2012 - and is on track to peak at $123 billion in 2015, according to the latest industry report from Futuresource Consulting.

2014/7/28

Worldwide demand for action cameras reached almost 5 million units in 2013 - which represented annual growth of 47% - and on track to reach 9 million units in 2018, according to the latest research from Futuresource Consulting.

2014/7/16

It's easy to get carried away with the idea that the increased availability of technology, broadcast programming and digital content has radically changed the make-up of children's playtime and altered overall habits for device usage and media consumption.

2014/7/16

The photo prints market continues to make up the lion's share of revenues within the European photo industry, last year generating revenues at retail that were 130% the size of the photobook and photo-merchandise markets combined, according to the latest research from Futuresource Consulting.

2014/6/20

The global spend on education technology within classrooms reached US$13 billion last year, up 11% on 2012, according to a new market study from Futuresource Consulting, the leading provider of education technology research.

2014/6/20

The videowall market maintained its strong growth trajectory in 2013, posting nearly 60% CAGR from 2009 to 2013 to reach sales of 449,000 units, according to a new industry report from Futuresource Consulting.

2014/5/14

Overall video entertainment spend in the UK is expected to reach ツ」10 billion by 2018, averaging 2% annual growth between 2014 and 2018. Pay-TV and subscription VoD services will be the key drivers, with transactional digital video showing moderate growth.

2014/5/14

Overall consumer spend on video and TV entertainment in Mexico grew by 9% in 2013 to reach USD$4.2 billion (54.5 billion pesos) and is forecast to reach USD$4.5 billion (58.8 billion pesos) in 2014, according to the latest research from Futuresource Consulting.

2014/5/14

After a weak performance from the global TV set market in 2013 - with revenues and shipments down 4% and 2.6% respectively - the segment is expected to return to growth in 2014, according to a new strategic report from Futuresource Consulting.

2014/4/14

Worldwide shipments of professional flat panel displays increased by 8% quarter-on-quarter in CYQ4 2013 to reach 567,000 units and finish the year with 20% volume growth, according to the latest research from Futuresource Consulting.

2014/4/14

Worldwide shipments of front projectors grew reasonably year-on-year by 6% to 2.12 million units in CYQ4 2013, representing $2.63 billion in value, according to the latest research from Futuresource Consulting.

2014/3/24

Global sales of interactive whiteboards and interactive flat panel displays in the education and corporate sectors reached 1.3 million units in 2013, up 1% on the previous year and making it the largest year on record, according to the final 2013 quarterly research report from Futuresource Consulting.

2014/2/24

The Western European consumer photobook market is on track to achieve unit sales of almost 27 million units in 2014, according to the latest photobook research from Futuresource Consulting, up from an expected 25 million in 2013.

2014/2/24

The global* pro camcorder market remained stable in 2013 with a decrease of less than 1% from the previous year, to reach 289,000 units in total, according to newly released figures from Futuresource Consulting. However, the end of year data shows that the stability of the overall market hides very different regional pictures.

2014/2/7

The global installed base of TV-centric connected devices surpassed one billion units in 2013 and will exceed two billion by 2017, driven by smart TV, IP-enabled set top boxes, game consoles, Blu-ray players and low cost digital media adapters, according to the latest research from Futuresource Consulting.

2013/12/20

Global penetration of mobile computing devices within K-12 education is forecast to reach almost 10% by the end of 2017, growing from just over 3% in 2012, according to Futuresource Consulting's quarterly tracking service 'Mobile Computing in Education'.

2013/12/20

The consumer wearable electronics segment - comprising wireless and smartwatches, activity trackers, wearable GPS, heart rate monitors and smartglasses - is experiencing a period of rapid growth with a forecast value of over $8 billion in 2013, according to the latest research from Futuresource Consulting.

2013/11/18

Action Camera sales in Europe are on track to grow 矜ャア17 million in 2013, to reach 矜ャウ61 million and are forecast to continue the strong growth for the next five years according to a new report from Futuresource Consulting.

2013/11/18

The worldwide AV headphones market is on track to ship 284 million units this year, equivalent to growth of 9% over 2012, with revenues forecast to reach $8.2 billion according to new research from Futuresource Consulting

2013/11/18

The smartphone market continues to see rapid growth worldwide, reaching 919 million units in 2013, representing a growth rate of 29% from 2012 and total mobile handsets grew 6.9% to reach 1.7 billion units. Also in 2013 for the first time, shipment volume of Smartphone handsets will overtake the number of standard handsets shipped and this trend will continue through to 2017.

2013/10/31

2013 is expected to be a landmark year for digital gaming, with the launch of Sony's PlayStation 4 and Microsoft's Xbox One, together with the growing role of non-dedicated gaming platforms, as the boom in smartphone and tablet adoption continues.

2013/10/1

Consumer uptake of 3D hardware continues apace, with the market on track to achieve 157.7 million 3DTV sales in 2017, up from a forecast of 59.3 million for 2013, according to a new report from Futuresource Consulting.

2013/9/25

50% of people across the UK, Germany, Russia and the USA are using their laptops to share digital images with their family and friends, according to a new consumer research study from Futuresource Consulting.

2013/9/25

With the launch of Xbox One and PS4 confirmed for Q4 this year (Asia 2014), the global packaged console games market will increase by $430 million in retail value in 2014, reaching ツ」18.7 billion according to a new console, handheld and PC gaming market report from Futuresource Consulting.

2013/8/26

August 2013 London, UK-Global Pay TV set top box (STB) shipments continue to grow, with demand expected to peak at 180 million units in 2016, according to new research from Futuresource Consulting.

2013/8/20

For the first half of 2013, sales of interactive whiteboards and interactive flat panel displays in the education and corporate sectors were up 20%, according to the latest quarterly research from Futuresource Consulting.

2013/7/29

The global TV market will return to growth in 2013 after shipments fell by 6% last year, with growth continuing out to 2017 according to a new report from Futuresource Consulting.

2013/6/25

Global shipments of Digital Media Adapters 矚ナ‥evices designed to stream content to the TV from the internet and IP connected devices 矚ナ『ill grow nearly 40% this year, with the market on track to double in size by 2017, according to a new industry report from Futuresource Consulting.

2013/5/1

The external hard disk drive market in EMEA had a difficult first half last year, mainly due to supply chain challenges in 2011, culminating in annual volumes for 2012 falling by 17% to 21.5 million.

2013/4/16

Global sales of mobile computing devices in K12 education exceeded 4.4 million units in Q4, with full year performance for 2012 increasing by 29% to reach 15.6 million, according to the latest research from Futuresource Consulting.

2013/3/6

Worldwide demand for camera accessories including lenses, bags, cases, supports and flashes, reached a trade market value of $5.1bn in 2012, according to a new global industry report from Futuresource Consulting.

2013/2/22

The USA consumer photo-merchandise market grew 18% to over $1.5 billion in 2012 and positive growth is expected to continue with the market developing to over $1.9 billion by 2015, according to the new photo-merchandise market report from Futuresource Consulting.

2013/2/5

Global tablet sales reached 64 million units in Q4 2012, representing quarterly growth of nearly 100% and year-on-year growth of 119%, according to the latest industry research from Futuresource Consulting.

2013/1/21

By Simon Bryant, Head of Consumer Electronics, Futuresource Consulting

Connectivity is rapidly becoming a standard feature across all consumer electronics products and is having a huge impact upon the way that people access content at home and on the move.

2013/1/17

The total global tablet market exceeded 32 million shipments in Q3 2012, growing 75% year on year, according to a new Tablet Market Update report from Futuresource Consulting.

2012/12/12

For calendar year Q3, sales of interactive whiteboards and interactive flat panel displays in the education and corporate sectors are up 22% year-on-year, according to the latest quarterly research from Futuresource Consulting.

2012/12/6

For calendar year Q3, sales of interactive whiteboards and interactive flat panel displays in the education and corporate sectors are up 22% year-on-year, according to the latest quarterly research from Futuresource Consulting.

2012/11/16

This is the sumamry report from Futuresource Consulting about Global CE Industry.

(PDF download only available)

2012/10/16

Global CE sales rose 6.3% in 2011, to reach $553bn, in spite of a challenging economic climate, saturation in key product categories such as TV, Cameras, and Home Video equipment, and the impact of floods in Thailand and residual effects of Japan earthquake.

2012/9/24

In 2011, the action cam market achieved 24% growth, reaching nearly 1.5 million units shipped, according to a new report from Futuresource Consulting.

2012/9/13

The global AV headphones market is expected to witness growth of 20% in 2012 to reach $6 billion in value, increasing from $5 billion in 2011, according to a new report from Futuresource Consulting.

2012/9/13

Whilst the education sector is not immune to the impact of the economic downturn, it is bucking the downward trends that are currently the norm in other sectors of the electronics market.

2012/8/31

The global video wall industry is experiencing renewed growth, with the market on track to reach 380,000 unit sales in 2012, equating to year-on-year growth of 60%, according to a new industry report from Futuresource Consulting.

2012/8/20

The global TV market is forecast to reach shipments of 239m units in 2012 according to a new TV market tracking report from Futuresource Consulting.

2012/8/10

After a reasonable start to calendar year 2012, the projectors market (excluding pico) had another solid quarter in Q2 2012, bolstered by strong demand in the corporate and home markets of Western Europe as Poland and Ukraine played host to the European Football Championships.

2012/8/1

With total global trade revenues in excess of $100 billion in 2011 and 30% further growth expected in 2012, the smartphone market is on track to become the largest consumer electronics segment in 2012, exceeding that of televisions.

2012/7/3

The games market across the USA and Western Europe is to witness steady growth through to 2015, reaching $15.7 billion and 矜ャア0.2 billion respectively in total retail value, according to new research from Futuresource Consulting.

2012/6/20

The consumer tablet market reached a global total of nearly 19 million units shipped in Q1 2012, growing by 188% from the same period in 2011, according to the latest Tablet Tracking report from Futuresource Consulting.

2012/6/11

Following several years of healthy growth, demand for set top boxes (STBs) continues to climb this year, on track to reach 228 million units shipped globally, according to a new report from Futuresource Consulting.

2012/5/18

Worldwide shipments of soundbars 矚ナ《eparate speaker units containing two or more speakers that are connected to a television - doubled in size between 2010 and 2011 to reach nearly 2.5 million units, with the market expected to enjoy further growth throughout the forecast period to 2016.

2012/5/7

Total global tablet sales including consumer, commercial, industrial and institutional exceeded 64 million units in 2011 and are on track to soar to 232 million units in 2016, according to the latest Tablet Technology and Markets report from Futuresource Consulting.

2012/4/25

The global outlook for 3D continues to be positive across the various entertainment platforms, according to a new strategic report from Futuresource Consulting.

2012/3/28

The mobile apps market has evolved significantly over the last two years, helping improve the range and quality of content available to consumers on their mobile phones, as well as providing opportunities for a whole range of industry segments to reach out to their target audiences and realise new revenue streams, according to a new market report from Futuresource Consulting.

2012/3/8

The global home entertainment sector, both hardware and content, remains fairly resilient in times of economic downturn, and although 2011 was a challenging year it would appear that the industry fared better than many others.

2012/2/20

By 2014, 60% of all home audio shipments across the USA, Western Europe and Japan will feature networking connectivity, according to Futuresource Consulting, rising from forecasts of 10% in 2012 as networking takes over as the major growth area.

2012/2/6

With forecasts exceeding 80% of units shipped by 2015, connected TVs are expected to lead the way in global TV shipments escalating from 27% in 2011, according to new research from Futuresource Consulting.

2012/1/23

London, 05 January 2012 - Futuresource Consulting has released a strategic research report focusing on the opportunities for personal computer devices within the K-12 education sector, showing a compound annual growth rate (CAGR) of 28% for 2011 to 2016.

2012/1/11

Highlighting many similarities in camera ownership and behaviour between consumers in the UK and USA, a new wave of consumer research by Futuresource Consulting looks into image-capturing and photo-sharing behaviours across these two major markets.

2011/12/27

The growing presence of online video has given rise to significant advances in the overall Russian home video market, with uptake in digital viewing triggering market growth forecasts in the region of 1000% in 2011, according to new research from Futuresource Consulting.

2011/12/8

Consumption of legitimate free and paid-for online video is on track to exceed 770 billion views across the USA, UK, France and Germany this year, according to a new report from Futuresource Consulting.

2011/11/17

Nearly 50% of consumers are using another electronic device while watching TV at home, according to findings from a new wave of 矚マュiving with Digital矚ム…onsumer research carried out by Futuresource Consulting.

2011/11/2

This is the sumamry report from the sessions which Futuresource Consulting addressed at the International Business Session of CEATEC JAPAN 2011 Official Conference�(PDF download only available)

2011/10/31

Futuresource has attended CEATEC JAPAN for many years however 2011 marked the first time Futuresource has teamed up with CEATEC JAPAN in an official capacity, as its 'knowledge partner'.

2011/9/28

The continued rise in the consumption of digital content in the home, whether through a laptop, PC, connected TV, games console or Blu-ray player has led to an increased demand for higher speed fixed broadband connections.

2011/9/15

Despite doubts about the world economy, the IFA Consumer Electronics Show in Berlin had a record number of visitors this year, at 238,000. Trade attendees were up 12% on previous years, exceeding 132,000, and nearly 40% of trade attendees came from outside Germany.

2011/9/6

Demand for photobooks from consumers in the USA continues to rise, providing a profitable revenue stream to many companies operating within the sector, with the market growing last year by nearly 25% to achieve in excess of 20 million units sold. Moving forward, this market is on track to make double-digit volume growth again this year and also through into 2012, with Futuresource forecasts predicting 25 million photobooks in 2011 and nearly 29 million in 2012.

2011/8/30

Analogue switch-off and the "eco points" discount scheme have had a massive impact on Japanese TV set demand but it is access to online video services through in-built IP Connectivity that will be key to driving demand in the near future.

2011/8/23

The continuing strong demand for smartphones has revitalised the global handset market, with the smartphone installed base expected to double by the end of 2011, compared with 2009 levels.

2011/8/16

Pure-play (online only) Internet radio and music streaming services continue to experience relatively high consumer usage, although revenue stream development remains key to the future.

2011/8/9

"There are around 10 million televisions being sold each year in the UK - and that's in a country that has just 25 million households," says Jim Bottoms, Director and Co-Founder, Futuresource Consulting, "which means every home is going out and buying a TV every two and a half years."

Vol.142012/1/23

London, 05 January 2012 - Futuresource Consulting has released a strategic research report focusing on the opportunities for personal computer devices within the K-12 education sector, showing a compound annual growth rate (CAGR) of 28% for 2011 to 2016.

As the global PC market continues to flatten off and revenue streams within enterprise and consumer segments become harder to sustain, the education sector is bucking the trend and opening up new areas of opportunity for vendors and component suppliers alike.

"There is no doubt that education is undergoing profound change in many countries across the globe, with the adoption of ICT as a learning tool forming the nucleus of this change," says Mike Fisher, Convergence and New Technologies Consultant, Futuresource Consulting. "From providing a richer, tailored learning environment to allowing students to study at their own pace, many governments are not only recognizing the benefits of ICT in the classroom, but are also going to great lengths to make sure 1:1 learning programmes are rolled out. The proven vote winning power of investment in education combined with declining prices and increased product customisation is developing considerable market demand. And with nearly 1.4 billion enrolled students and teachers across the world, this clearly represents a significant opportunity for vendors."

In addition to hardware supply, the content and delivery infrastructures are vital to an effective and successful rollout. As a result, telecommunications companies have become increasingly involved in technology deployments into education. Their role can be seen in various elements of projects, from funding and financial contributions to networking the devices or distributing hardware and content. These companies have a keen interest in being involved, as an increasingly IT-dependent student population will naturally result in increased content consumption in the long term. As a result, the telecommunications industry is - and will continue to be - a major source of non-governmental funding.

Futuresource research shows that global PC shipments into education exceeded 11 million units in 2011, with a significant amount of activity taking place in Central and South America.

"A number of substantial nationwide rollouts took place last year," says Fisher. "In Argentina, the Conectar Igualdad project reached its stage two goal by mid-2011, deploying 1.2 million devices across the country. Preparations are now being made for the final stage, which should see similar numbers deployed in 2012. Over the border in Uruguay, the Plan Ceibal project now has 100% ICT penetration in primary schools and is expected to get close to 100% penetration in secondary schools in 2012."

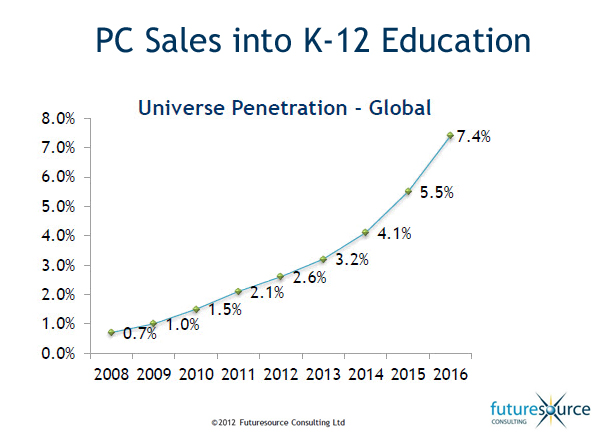

With strong expectations of multiple government tenders during 2012 and beyond, Futuresource forecasts indicate large sales volumes across many territories, with global shipments reaching close to 12 million units in 2012, rising to over 40 million units by 2016, though the installed base will still represent less than 8% penetration in 2016.

Potential market entrants need to tailor their strategies to the different decision making hierarchies, purchase responsibilities and power bases that define each country.

"We've been tracking education markets for more than ten years and it is clear that there is little correlation between a region's economic prosperity and the investment in school spending," says Joe Mugan, Market Analyst, Futuresource Consulting. "The key determining factor is government support for ICT usage in the classroom, often driven by the positive messages that this sends out to the electorate. However, many large and financially established countries – such as Germany and Japan – have concentrated on traditional teaching methods and as a consequence technology adoption in schools has remained relatively low. The interest is coming from elsewhere: the areas to watch this year include Turkey, Thailand and the Middle East, where multi-billion dollar nationwide tenders are likely to be initiated."

"The speed of market rollout is dependent on the complexity of the decision making structure in each country. Widespread and rapid adoption of ICT is typically easiest when budgeting is carried out centrally, although there are huge opportunities for vendors regardless of a country's governmental structure, as long as a vendor's resources are focused on the right target at the right time, with strategies optimized to the nuances of the country. Make no mistake, once a government decides to invest in education, the implementation can be fast and the expenditure enormous."